Roland Berger, a strategic consultancy, intends to organize regular breakfasts with leaders of the health sector in the broad sense. The first of them, December 13, 2021, was with Ramón Berra, General Director of the Miranza ophthalmology company.

Origin of the company

The Miranza company was born in 2019 and consists of a set of clinics dedicated to ophthalmology, its origin being the merger of the IMO of Barcelona and some Innovaocular clinics (San Sebastián, Madrid, Seville and Cádiz).

It is based on the fact that ophthalmology is a non-hospital specialty, which can be developed without problems in a non-hospital environment and it was possible to consolidate a series of clinics to form a prestigious professional company dedicated to ophthalmology in its entirety and different subspecialties. In this sense, they differ from other ophthalmological chains, dedicated almost exclusively to refractive surgery.

Miranza, today

The company has 20 centers throughout Spain and on Friday, December 17, 2021, it begins its international career with the first center in Andorra.

It is a company that has grown mainly through acquisition, presence in large cities, with medium and high complexity surgery, always led by teams of ophthalmologists with recognized prestige, at least locally.

Acquisition method

Miranza’s approach to a prestigious ophthalmological group is to buy the company (100%), never the property, with which ophthalmologists can continue to receive income as owners of rented properties; with a service provision contract (which specifies a service period and a “non-compete” period) and they are offered the possibility of reinvesting in the parent company and thus becoming minority partners of Miranza.

Miranza has approached the great ophthalmologists of this country, in such a way that it can be said that around 70% of ophthalmology leaders collaborate with Miranza.

An original formula for Medical Management

Miranza has launched an original formula for the group’s Medical Directorate. The key role of medical leadership and the difficulty of forming a recognized medical leadership need not be stressed when there are many medical leaders in the same specialty. The formula is that of the Clínical Leader Forum, a collegiate medical directorate, made up of 9 ophthalmologists.

The pandemic has not impeded the growth of Miranza

Miranza was founded in 2019. Arguably, the onset of the pandemic in early 2020 could have derailed the plan. But nothing further, despite the pandemic, Miranza has grown in the level of billing, number of patients, activity and knowledge.

He doesn’t want to be a “Frankenstein”

Miranza has developed protocols and clinical guidelines, since his intention is not to become a Frankenstein of ophthalmology, but to constitute something of value, beyond the value of the different members.

To do this, it has launched a network, with the idea of sharing knowledge and clinical guidelines for action. This approach has groups of the different subspecialties of ophthalmology (retina, glaucoma, anterior segment, cataracts, etc.)

It also has an Intranet, to share experiences throughout the group.

Miranza Academy

A very interesting experience is the launch of this initiative. In the middle of the pandemic, there were 4 daily training webinars.

They also do two weekly clinical sessions.

Investigation and development

Miranza is aware that the only way to maintain and strengthen its leadership position is through extensive R&D activity. That is why it has a corporate R&D team to which in 2020 it has dedicated 7 million euros.

They have 90 multi-center projects, 2 European projects, public sector funded research, and industry agreements for multi-center trials.

All centers have their R&D coordinator.

The creation of the brand

The Miranza brand was created after a very participatory work with a branding agency (suggests look and hope).

Miranza’s policy with previous brands is to put Miranza as a name, respecting the original names as surnames. Only in the case of IMO and Vissum, due to their great presence, it is done the other way around, those brands are respected as a name and Miranza is given as a surname.

An effort in telemedicine

Apart from online dating, Miranza has made an effort in the development of telemedicine, particularly for second opinions.

It has even been seen that the consultation / surgery conversion ratio is higher in second opinions than in normal consultations.

A concern for quality

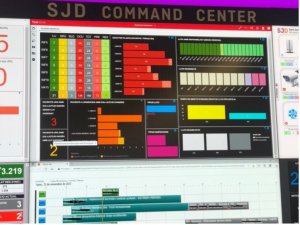

The IMO is accredited by the Joint Commission and for its part, Miranza has developed a set of healthcare quality indicators, which are analyzed on a monthly basis.

Patient experience

Miranza is going to launch a patient portal, in order to follow and improve the patient experience in the company

A bit of numbers

73% of Miranza’s billing is to private patients, only 20% is made to insurance companies. It also has a small collaboration with the Administration for issues of the waiting list, but it is an area in which it does not want to grow, given the danger of phagocytization by way of the waiting list of normal activity.

In terms of turnover, it has 80 million euros of sales and 11 million of EBIDTA.

A great effort in operations

Payroll, accounting and treasury are centralized.

A purchasing center has been set up and a catalog of approved materials has been developed, including intraocular lenses. There is an agreement with ophthalmologists by which 70% of the lenses that are placed have to be from the corporate catalog; for the remaining 30% they have freedom of choice.

There is a central contact center, which allows a homogeneous treatment of calls.

An effort has also been made in systems, adding a layer to the pre-existing systems, which allows to have a minimum electronic medical record and a management control panel.

The future

Miranza wants to continue growing, developing in areas of Spain where it is not, also in Portugal, without forgetting future projects in Latin America and North Africa.

Miranza receives many calls from ophthalmological consultations who want to explore joining the company, from which we can deduce that Miranza arouses attraction among these professionals.